TIA’s Tire Dealers at 2 Discusses Risk Management

The Tire Industry Association (TIA) hosted its Tire Dealers at 2 seminar at the Specialty Equipment Market Association Show and focused on risk management in retail tire shops.

Tyson Wedin, regional risk manager for Federated Insurance, took the stage to tackle big problems that tire dealers need to stay in front of to avoid lawsuits.

Wedin split his seminar up into sections – automotive and general liability.

Automotive

According to Wedin, automotive claims keep getting higher and higher and that is because distracted driving is becoming a lot more prevalent.

“Every claim has a value, and that value keeps going up whether that means the vehicle is totaled, someone is injured or something else,” says Wedin.

“There is some dollar amount associated with those examples. A claim that ten years ago would maybe be a $1 million claim is now a $10 million claim.”

This comes down to five main things – social inflation, nuclear lawsuits, reptile theory, jury anchoring and third-party litigation financing.

Social inflation is the increase of cost in insurance claims and litigation payouts due to social and behavioral trends.

Wedin uses the example of sports players signing millions of dollars in contracts.

“A few years ago, a $10 million contract would have made the news – these guys are making a lot more than that now,” says Wedin.

“Things are inflated whether that be through social media or the jury verdicts.”

A nuclear lawsuit is a jury award of $10 million or more. Another term is thermonuclear lawsuit which is $100 million or more.

These types of lawsuits are becoming more and more popular and can be detrimental for independent tire dealers if they are caught in one.

Reptile Theory is most commonly used by plaintiff attorneys to strike fear in the jury about the business or person being sued.

“It essentially makes the jury want to punish the company – so be aware of this tactic because these attorneys are good at this and this is becoming more and more common,” says Wedin.

Jury anchoring is similar to the Reptile Theory in the way that the plaintiff’s attorney will set a reference point that is really high so that the jury will use that as a jumping-off point and decide on a smaller, but substantial amount.

Third-party litigation funding is when a third party invests in a lawsuit in exchange for a percentage of the payout.

“You need to recognize that you could be a target for any of these things,” says Wedin.

Wedin says to provide PPE that improves employees' driving behavior so that none of the above happens.

Cameras are a great way to do this, according to Wedin, in the work vehicles employees are driving.

This provides protection to a tire dealer's business by having evidence of what employees were actually doing and that can help a tire dealer make the correct decision in taking action.

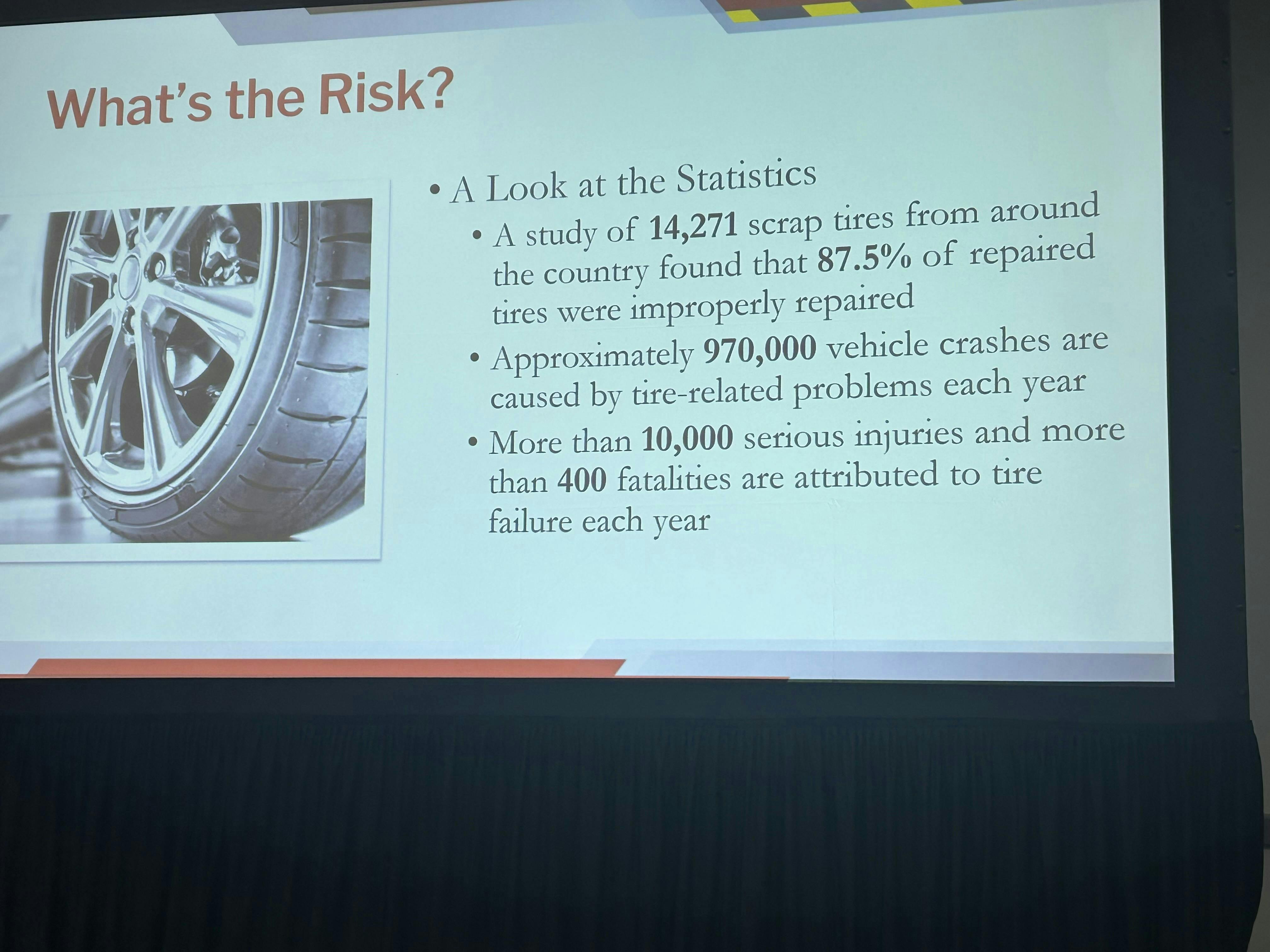

Tire failures

Wedin asked the dealers in the room if they believed their employees could recognize a faulty tire, properly repair a tire or if they would feel comfortable explaining tire sales and repair procedures to a group of peers.

He asked this because he is seeing more and more plaintiffs trying to shift the responsibility of accidents from vehicle owners to tire repair shops.

“This is why it is so important to be proactive and manage your risks – follow industry standards, train employees, manage your inventory and keep records,” says Wedin.

Kevin Rohlwing, chief technical officer for TIA and moderator of the seminar, says dealers should also stay away from selling or using used tires.

“Used tires are very risky and you better have a well-documented plan on inspection, determination, age, tread depth, condition and everything,” said Rohlwing.