‘I’m Tired of My Supplier Competing Against Me’: Online Sales Remain a Sore Point

Last year, U.S. consumers purchased 14.1 million passenger and light truck tires online. The total represents 6% of all aftermarket tire sales at the retail level.

That number is expected to increase in the next few years, primarily because millennial buying patterns are changing the face of retailing. And an increasing number of online-only tire retailers are making it possible.

But there is no reliable research that supports buying tires online will significantly replace tire purchases at retail stores. No matter where they buy their tires, consumers have to visit brick-and-mortar stores to get them installed, which changes the dynamic of online selling for tires.

There is, however, recent data on what both consumers and independent tire dealers have to say about online tire sales. Modern Tire Dealer commissioned both surveys.

The results confirm two things: Online selling by tire manufacturers remains an unresolved issue with tire dealers; and consumers seem to be willing to try online tire buying.

Whether you decide to join an online tire retailer’s installer network or rely on your own website, here’s what you need to know about online sales and selling online.

Defining moments

”As consumer demographics continue to shift and 80 million millennials come into the marketplace, we have to meet their shopping experience.” Rich Kramer, chairman, CEO and president, 2015 Goodyear Annual Report

“Buying tires online” refers to the complete payment of the tires on the website itself. If the consumer has to pay for the tires in person, then the customer did not buy them online; they were just ordered online.

Reinalt-Thomas Corp., which does business as Discount Tire, and Tire Rack Inc. are the pioneers of online tire selling. Discount Tire began selling online through its Discount Tire Direct subsidiary in May 1994, only 13 months after, as the World Wide Web Foundation describes it, the underlying proprietary code needed to open the web to the world was made available royalty-free forever to anyone who wanted to take advantage of it. Tire Rack followed suit in 1998.

Both companies evolved their innovative internet business models from their respective mail-order businesses. Tire Rack began selling specialty tires by mail as early as 1982; Discount Tire’s mail-order business survived the failure of its Tires Plus Club in California.

A number of start-up companies jumped on the bandwagon from 1998 to 2012, with some of them cannibalizing sales from each other. But the decision by Goodyear Tire & Rubber Co. to sell tires directly from its goodyear.com website, announced at the 2015 Goodyear Dealer Conference, was met with both excitement (according to Goodyear) and skepticism (dealer outcry). Goodyear was the first tire manufacturer to directly sell its tires online. Michelin North America Inc., with its bfgoodrichtires.com and michelinman.com websites, also sells tires online.

In a nutshell, Goodyear believes offering consumers, especially millennials, the opportunity to buy and pay for tires when they visit goodyear.com will be a win-win for both Goodyear and the dealer. Goodyear gets the sale, and the dealers get 1) a delivery fee from Goodyear, 2) all installation charges, and 3) the opportunity to generate additional service revenue from consumers they would not see normally.

Here’s what the dealers think.

Dealer survey

”I feel all tire manufacturers will all sell tires online as it is the wave of the future. We are signed up for the installer programs. The vast majority of these customers so far have been bottom feeders. The majority don’t want an alignment or any other services. The tire manufacturers tell us it attracts new customers. What a joke!” Jerry Reygaert, owner, Rey’s Auto & Tire Inc., Utica, Mich.

The relationship between independent tire dealers and their tire suppliers is a complicated one. Many wholesale suppliers allow dealers to buy their tires from them online. American Tire Distributors Inc. (ATD) went a step further when it created TireBuyer.com for consumers, and partnered with its tire dealer customers.

To date, TireBuyer.com’s installer network consists of 9,000 dealers who not only keep their installation costs, but also the selling price of the tire, minus ATD’s normal wholesale price.

With tire manufacturers it is different. Both Goodyear and Michelin drew the ire of some of their dealers by keeping the tire cost minus an average stipend of close to $12 a tire, depending on the tire.

Nearly 60% of the respondents to MTD’s Online Sales Research Study of Independent Tire Dealers said they did not participate in any tire manufacturer online sales programs.

Then they were asked, “If your main tire brand supplier started an online sales program, would you participate?” more than half of the respondents said “Yes.”

Of the 44% who said “No,” the most common reason for not participating was “I’m tired of my supplier competing against me.”

Here is a breakdown of all the reasons why they would not participate (the dealers were asked to list one or two main reasons for not participating):

67%: I’m tired of my supplier competing against me.

52%: The program devalues my role as an expert in the business.

48%: We like to interface with the consumer directly.

40%: Don’t want to lose the profit in a tire sale itself.

30%: Don’t believe the customer will make the right choice.

29%: Too much hassle for too little additional business.

18%: Don’t want the hassle of credits for the tire sales.

17%: Other.

The study also asked if dealers would be interested in online sales programs created by any of their tire suppliers. Half of the dealers said they would not participate, with a similar breakdown in the reasons given for not supporting an online sales program created by their main supplier. Fifty percent said they were tired of their suppliers competing against them.

Consumer survey

”The consumer experience can be bumpy. After they complete the online transaction, the odds of them getting their credit card out for any other purchase is very low.” Randy Jones, president, Tireman Auto Service Centers, Toledo, Ohio

According to MTD’s Online Sales Research Study of Consumers, price and previous online buying experience were key factors in choosing to buy via the internet.

- Over half of those buying online made the transaction through computer/laptop, with over a third using a smartphone device instead. Mobile usage, often referred to as m-commerce, is growing in all online retail sales.

- 80% of consumers buying online were either very satisfied or extremely satisfied with how the installer treated them.

- Virtually all of the consumers surveyed who bought tires online would do it again.

- 50% of those people who bought online had previously bought tires online.

It should be noted the survey respondents buying online appeared to have had more experience with long-standing online sellers like Tire Rack than they did with the relatively new tire manufacturers’ websites, which at the time were still being fine-tuned. This may have skewed the results to some extent.

Among those surveyed who had bought tires, but not online, the local independent retailer was the “go-to” source for more than a third of them, with nearly a third choosing a large independent tire retailer. And the respondents said the retailers were chosen primarily on the basis of either trust or price offered.

Among those who had bought tires in last 12 months but had not purchased them online, one-third of them said they had considered it before deciding not to.

The major players

”I think every manufacturer is considering going directly to the consumer.” John Aben, senior vice president of OE and consumer sales, Giti Tire (USA) Ltd.

Tire Rack and Discount Tire Direct remain the dominant business-to-consumer (B2C) web retailers to this day, accounting for the majority of the distribution channel’s 6% market share. Combined, they account for close to 10 million of the 14.1 million in domestic replacement unit sales. Tire Rack’s business model also encompasses B2B tire sales.

The following 12 websites are currently leading retail sellers of tires online. There are other players in the market, but these are the websites that rank high in a variety of keyword searches when using leading search engines.

- TireRack.com 2. Discounttiredirect.com

- TireBuyer.com 4. Simpletire.com

- 1010Tires.com 6. Onlinetires.com

- RightTurn.com 8. Tires-easy.com

- Amazon.com 10. Goodyear.com

- Michelinman.com 12. BFGoodrichtires.com

Here is a synopsis of each of the major players. Because the Michelinman.com and BFGoodrichtires.com websites are run differently, they are listed separately.

1. Tire Rack (www.tirerack.com)

Headquarters: South Bend, Ind.

Began selling tires online: 1998

No. of warehouses: 7 (more than 2.2 million square feet)

Offers 24 tire brands: Avon, BFGoodrich, Bridgestone, Continental, Dick Cepek, Dunlop, Falken, Firestone, Fuzion, General, Goodyear, Hankook, Hoosier, Kumho, Laufenn, Michelin, Nexen, Pirelli, Power King, Riken, Sumitomo, Toyo, Vredestein and Yokohama.

Write-up: Although family-controlled, the Leonard Green & Partners investment firm has had a minority ownership in the company since 2005. It has more than 8,000 “independent recommended installers.” In 2014, tirerack.com received more than 50 million visitors.

2. Discount Tire Direct (www.discounttiredirect.com)

Headquarters: Phoenix, Ariz.

Began selling tires online: 1994

No. of warehouses: 4, with free shipping in the 48 contiguous states

Offers 54 brands: includes the three anchor brands (Goodyear, Bridgestone and Michelin)

Write-up: Discount Tire has a full-time metrics analyst and uses web analytics tools to gauge the effectiveness of all of its internet-based marketing efforts. It has a long list of “qualified installers” in all 50 states that extends beyond its 1,000 stores.

3. TireBuyer (www.tirebuyer.com)

Headquarters: Huntersville, N.C.

Began selling tires online: 2009

No. of warehouses: more than 140 warehouses in the U.S. and Canada, with more than 800 delivery trucks

Offers 20 tire brands: Michelin, Bridgestone, BFGoodrich, Firestone, Uniroyal, Fuzion, Goodyear, Continental, Dunlop, General, Kelly, Kumho, Mickey Thompson, Nexen, Nitto, Dick Cepek, Cooper, Falken, Ironman, Carlisle

Write-up: The program was introduced in 2007 by American Tire Distributors. Tire buyers also have the option of buying online on the www.TirePros.com website; although its “buy now” button is an affiliate link to the TireBuyer.com platform, it doesn’t include a “ship-to-home” option.

4. SimpleTire (simpletire.com)

Headquarters: Trevose, Pa., with satellite offices in Utah and India

Began selling tires online: 2010

No. of warehouses: 0

Offers 269 brands: includes the three anchor brands (Goodyear, Bridgestone and Michelin)

Write-up: “Instead of buying and reselling tires like other retailers, SimpleTire uses data and technology to aggregate tire inventory... from more than 500 suppliers across the country,” says the company. “These suppliers compete with each other on price, selection and delivery.” It has a vast network of thousands of distributors and installers.

5. 1010Tirescom (www.1010tires.com)

Headquarters: British Columbia, Canada

Began selling tires online: July 2000

No. of retail stores in Canada: 4

Offers 30 tire brands: includes the three anchor brands

Write-up: The company ships by United Parcel Service (UPS) Standard Ground service to the U.S.; for Canadian orders, it also uses Purolator, Canpar and Nationex. It prefers to ship an order to the billing address of the credit card or to one of its “certified installers.”

6. Onlinetires.com (www.onlinetires.com)

Headquarters: La Mirada, Calif.

Began selling tires online: 1998

No. of warehouses: 5

Offers 56 tire brands: includes the three anchor brands

Write-up: Onlinetires.com is part of American Tire Depot, a 91-store retail chain. Ara Tchaghlassian is company president. It markets itself as “Home of the lowest-priced tires on the web.” Another website, superbuytires.com, is also part of company.

7. RightTurn (www.rightturn.com)

Headquarters: Cleveland, Ohio

Began selling tires online: 2012

No. of warehouses: 42 in the U.S. and Canada

Offers 15 OE tire brands: BFGoodrich, Bridgestone, Continental, Dunlop, Firestone, General, Goodyear, Hankook, Kumho, Michelin, Nexen, Pirelli, Toyo, Uniroyal and Yokohama. Write-up: The program was created when Dealer Tire LLC tested the pilot program in the Dallas/Fort Worth area; the program soon expanded to northeast Ohio. In June 2016, the company rolled out the program nationwide. The network has more than 8,000 “factory-certified installers” (i.e., franchise automobile and light truck dealerships).

8. Tireseasy LLC (www.tires-easy.com)

Headquarters: Benicia, Calif.

Began selling tires online: 2008

No. of warehouses: 0

Offers 112 tire brands: showcases 12 on its home page: Cooper, Falken, Goodyear, Hankook, Toyo, Achilles, Michelin, Bridgestone, Nokian, Milestar, Nankang and Vredestein

Write-up: The website is owned by Delticom North America Inc. “We offer fast delivery, affordable shipping rates, free road hazard combined with a 45-day money back guarantee.” It partners with Kevin Byrd and Willie B, hosts of the “Two Guys Garage” cable television show.

9. Amazon (www.amazon.com)

Headquarters: Seattle, Wash.

No. of warehouses: 0

Offers 51 brands: includes the three anchor brands

Write-up: Amazon.com Inc. does not buy direct from manufacturers, based on MTD research.

In its 2015 fiscal year ended Dec. 31, 2015, Amazon.com Inc. sold $63.7 billion worth of goods online in North America. That included tires and automotive parts. ComScore Inc. says Amazon is “evolving its digital strategy to new platforms and is even getting into brick-and-mortar retail.” Amazon has tire installation available at what it calls “pros” locations. “We only invite providers who have a strong track record of service quality,” says Amazon.com. “We screen through a combination of media searches, online interviews, and reference checks.” There remain gaps in its network.

10. Goodyear (www.goodyear.com)

Headquarters: Akron, Ohio

Began selling tires online: 2012 (testing program); launched nationwide in 2015

Write-up: At the 2015 Goodyear Dealer Conference, the company shared these stats about selling tires online: nearly 60% of the consumers who purchased online were new customers to the installing location; and 38% of these new consumers returned to the installing location for more service. Close to 5,000 “authorized local installers” have signed up to be part of the program.

Nick Mitchell, head of research for Northcoast Research Holdings LLC in Cleveland, Ohio, estimated Goodyear sold 200,000 online through www.goodyear.com in 2016.

11. Michelin (www.michelinman.com)

Headquarters: Greenville, S.C.

Began selling Michelin tires online: 2017

Write-up: Michelin will only ship to dealers who are part of its “Service Provider” network. The service providers, which are also part of Michelin’s Authorized Dealer Network, have to meet a series of standards in order to participate in the online program.

12. BFGoodrich (www.bfgoodrichtires.com)

Headquarters: Greenville, S.C.

Began selling BFGoodrich tires online: September 2016, in the greater Charlotte area

Write-up: As of Oct. 12, BFGoodrich tires could be bought online in 38 states and the District of Columbia.

Sears, Roebuck and Co. sells tires online through its Sears Auto Centers (www.searsauto.com) and Sears Auto Digital Tire Journey app.

Bridgestone Americas Inc. (www.bridgestonetires.com) does not sell online directly; with its TireConnect software tool, it works with the websites of its dealers, allowing them to get full credit for online tire sales, plus remain in control of their inventory, pricing and labor/installation costs. Similarly, TreadHunter Inc. (www.treadhunter.com) only connects neighborhood retail tire stores directly to internet consumers.

Future growth

”As online tire retail penetration grows to around 24% in Europe and 12% in North America by 2023, offline tire retail will transform to offer a seamless tire purchase experience in tandem with e-retailers.” Frost & Sullivan, March 2017

The tire industry is nothing like the apparel or consumer electronics industries. As they relate to online retailing, tire sales are reliant on an additional service that, realistically, only can be performed with the help of skilled hands, bricks and mortar.

However, as millennials and members of the iGeneration replace the Baby Boomers, the way all products, including tires, are bought and sold online will continue to evolve.

Goodyear updated its online tire sales program in July when it launched Dealer Match program, a direct result of dealer feedback, says the company. The program allows dealers to match Goodyear.com pricing in-store while maintaining typical margins associated with an in-store sale.

Tire sales on Amazon.com could grow dramatically, but only if it can 1) add warehousing or find partners willing to share their tire inventories; and 2) expand its limited network of installers. ComScore has said Amazon is adding brick and mortar to its business model, but all things being equal that will increase costs, and as a result, tire pricing.

Amazon.com’s size has already led to “Amazon laws” in 34 states, which require sales tax be charged by large online sellers.

In addition, both houses of Congress have introduced bills that would require online sellers with annual gross sales of more than $1 million to collect sales tax in 45 states (five states have no state sales tax). That may help bridge the competitive gap in pricing between online retailers and tire dealerships. ■

Online tire pricing

”Product pricing, which tends to be 20% to 40% lower online for automotive parts, has been the primary driving factor behind e-retailing growth in this segment. However, the dominant presence of low-cost, ‘bricks’ mass merchants such as Wal-Mart and Costco, have kept tire pricing fiercely competitive through traditional channels, particularly in the U.S., leaving little incentive for consumers to purchase their tires online.” Kumar Saha, research manager, Frost & Sullivan, 2014

Online tire pricing varies greatly depending on the website. The Fitment Group collected these advertised prices for two specific tire lines.

Advertised web pricing, week of 5-14-2017

1. Goodyear Wrangler ATS, size 265/70R17

bigotires.com $158.76

goodyear.com $179.00

merchantstire.com $176.37

ntb.com $175.55

pepboys.com $199.99

tires.com $147.00

tiresetc.com $138.00

Walmart.com $149.00

2. Hankook Dynapro ATM RF10, size LT235/75R15 LRE

dunntire.com $109.09

mavistire.com $119.99

onlinetires.com $96.86

sears.com $113.20

simpletire.com $108.99

tirerack.com $99.25

townfairtire.com $117.00

walmart.com $95.00

Not all the websites were set up for selling online. For example, dunntire.com offers up a quote and then requires the customer to schedule an appointment – with no money changing hands online.

Source: The Fitment Group

SURVEY RESULTS

Sources for all charts not credited: Modern Tire Dealer Online Sales Research Studies, June 1, 2017. Numbers may not equal 100% because they are rounded.

Tire dealers: The majority doesn’t participate

When independent tire dealers were asked if their companies participated in any tire manufacturer consumer online tire sales program, the breakdown was as follows:

Tire dealers: Satisfaction level

According to Modern Tire Dealer’s Online Sales Research Study of Independent Tire Dealers, 42% of the respondents participating in the goodyear.com consumer online sales program said they were “Moderately satisfied” with it.

Consumers: Online tire purchasers

Of the respondents who purchased tires between May 1, 2016, and May 16, 2017:

Consumers: Ease of buying online

When asked, “On a scale of 1 to 5, where 1 is ‘Not at all difficult’ and 5 is ‘Extremely difficult,’ how difficult was it to find tires and make the purchase?” 60% said not at all difficult.

Consumers: Online tire pricing

When asked, “Why did you choose to buy tires online?” respondents said price was a big factor.

Consumers: Satisfaction with the installer

Four-fifths of consumers buying tires online were either very satisfied or extremely satisfied with how the installer treated them.

Consumers: Devices of choice

When asked, “On what device did you use to purchase your tires online?” many survey respondents preferred buying with their iPhones, Android phones or Windows phones.

Consumers: Repeat customers

When asked, “Would you buy tires online again?” the online purchasers overwhelming responded “Yes.”

Consumers: Non-online purchasers

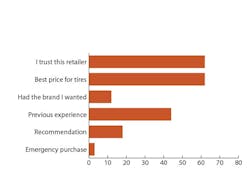

Of the respondents who purchased tires between May 1, 2016, and May 16, 2017, 21% did not buy online. When asked, “Why did you buy your tires from this retailer?” respondents answered as follows: